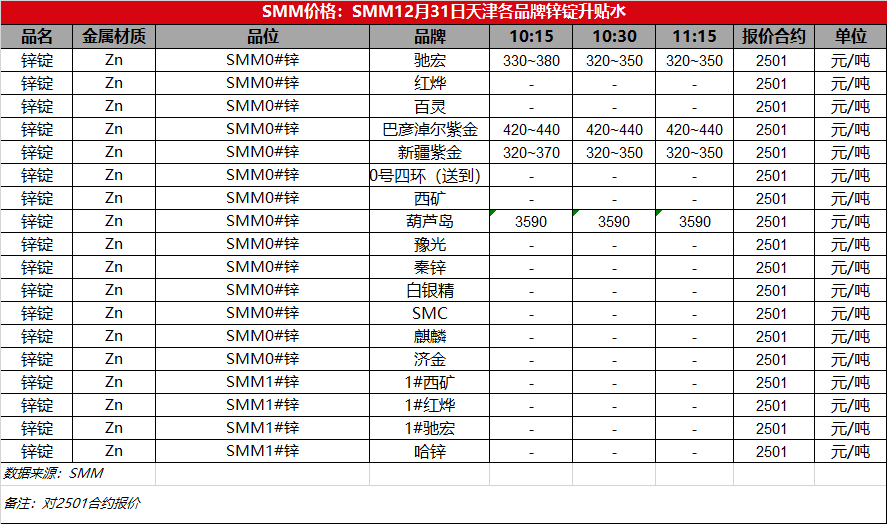

SMM reported on December 31: In the Tianjin market, mainstream transactions of 0# zinc ingot were at 25,890-26,050 yuan/mt, Zijin traded at 25,990-26,110 yuan/mt, and 1# zinc ingot traded around 25,450-25,560 yuan/mt. Huludao was quoted at 29,260 yuan/mt. The premium for ordinary 0# zinc against the 2501 contract was around 320-380 yuan/mt, while Zijin's premium against the 2501 contract was around 420-440 yuan/mt. The Tianjin market held a premium of 20 yuan/mt over the Shanghai market. As of the midday close, Xinzi's premium against the 01 contract was 320-370 yuan/mt, Chihong's premium against the 01 contract was 330-380 yuan/mt, while Xikang and Bailing had no quotes for the 01 contract. High-end brand Zijin's premium against the 01 contract was around 420-440 yuan/mt. The futures market mainly fluctuated within a narrow range. Many traders had closed their accounts, resulting in fewer quotes today. Downstream restocking was mainly driven by rigid demand, and overall market transactions were moderate.